How to Maximize 401(k) Savings: A Comprehensive Guide

Introduction

With the rising cost of living and uncertain economic conditions, securing financial stability in retirement is paramount. 401(k) plans offer a tax-advantaged way to save for the future, and maximizing contributions is crucial for building a substantial nest egg.

Contribution Limits

The IRS recently announced the contribution limits for 401(k) plans in 2023. Employees under age 50 can contribute up to $22,500, while those 50 and older can contribute an additional $7,500 as a catch-up contribution. Employers may also make matching contributions, further boosting savings.

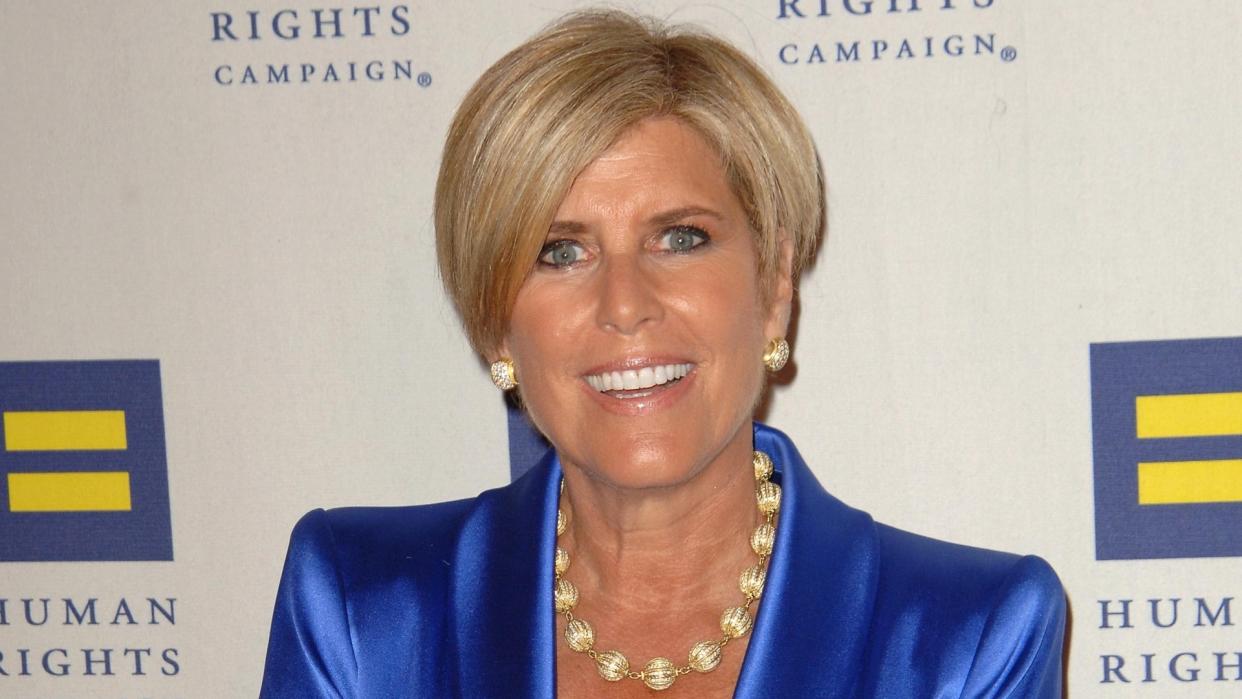

Suze Orman’s Guide

Renowned financial expert Suze Orman recommends contributing as much as possible to a 401(k) plan. She suggests starting with 10% of your income and gradually increasing the percentage as your income grows. Orman also emphasizes the importance of taking advantage of employer matches, which are essentially free money.

Benefits of Maximizing Contributions

Maximizing 401(k) contributions offers several benefits:

- Tax savings: Contributions are made pre-tax, reducing your taxable income.

- Tax-deferred growth: Earnings within 401(k) plans grow tax-deferred until withdrawal, allowing investments to compound faster.

- Additional savings: Matching contributions from employers increase your overall savings, even if you contribute less.

- Retirement security: Building a substantial 401(k) balance provides financial stability and peace of mind in retirement.

Challenges and Considerations

While maximizing 401(k) contributions is beneficial, there are some challenges to consider:

- Contribution limits: The IRS-set contribution limits may not be sufficient for everyone, especially those with higher earning potential.

- Investment selection: Choosing the right investments within a 401(k) plan can be complex and requires careful consideration.

- Liquidity restrictions: Withdrawals from 401(k) plans before age 59½ typically incur penalties, limiting access to funds in an emergency.

- Taxes on withdrawal: Distributions from 401(k) plans are taxed as ordinary income, which can significantly impact your overall tax bill.

Perspectives from Experts

Financial experts have varying perspectives on maximizing 401(k) contributions:

- Aggressive approach: Some experts recommend contributing as much as possible to 401(k) plans to maximize tax savings and long-term growth.

- Balanced approach: Others suggest a more balanced approach, considering other financial goals and the potential risks of overfunding 401(k) plans.

- Diversification: Experts also emphasize the importance of diversifying investments within 401(k) plans to reduce risk and potential losses.

Case Studies

Two case studies illustrate the potential benefits and drawbacks of maximizing 401(k) contributions:

- Sarah: A 35-year-old who earns $100,000 and contributes 15% of her income to her 401(k) plan. She receives a 5% employer match. By age 65, her 401(k) balance is estimated to be over $1 million.

- John: A 55-year-old who earns $150,000 and contributes the maximum $22,500 to his 401(k) plan. However, he has significant other debts and expenses. At retirement, he may face financial challenges if he relies solely on his 401(k) distribution.

Conclusion

Maximizing 401(k) contributions can significantly enhance retirement savings and financial security. However, it is important to weigh the benefits against the potential challenges and consider your individual financial situation. By carefully considering the contribution limits, investment options, and potential risks, you can develop a sound strategy to maximize your 401(k) savings and achieve your financial goals in retirement.